Traçabilité Numérique

Qu'est-ce que la Traçabilité Numérique ?

La Traçabilité Numérique par DigitalGate est un système développé pour suivre le mouvement des produits à toutes les étapes de la chaîne d'approvisionnement grâce à l'utilisation de codes DataMatrix 2D uniques

Code DataMatrix

Un code DataMatrix est un code 2D composé de pixels noirs et blancs disposés en grille carrée ou rectangulaire. Les lignes verticales et horizontales forment le motif de repérage en forme de « L ». Leur chevauchement dans le coin inférieur gauche indique le premier pixel à partir duquel le code est lu.

Les codes DataMatrix peuvent être carrés ou rectangulaires et contenir toute information codée sous forme de lettres, chiffres et symboles

Comparé à un code QR, un code DataMatrix est plus économique en espace grâce à sa densité de données plus élevée et possède son propre mécanisme de correction d'erreurs — ce qui signifie qu'il peut être lu même s'il est endommagé

Chaque code DataMatrix contient des informations sur le produit et un numéro de série. Ces codes sont sécurisés par des technologies de chiffrement avancées, ce qui les rend impossibles à falsifier ou à modifier.

L'objectif principal de la Traçabilité Numérique est de protéger les consommateurs contre les produits contrefaits, dangereux et de mauvaise qualité

Comment fonctionne la traçabilité ?

Le système enregistre chaque mouvement de produit, depuis la fabrication ou l'importation jusqu'à l'achat par le consommateur final.

1. FABRICANT / IMPORTATEUR

Le fabricant ou l'importateur applique les codes DataMatrix sur l'emballage et envoie les produits au distributeur2. LOGISTIQUE

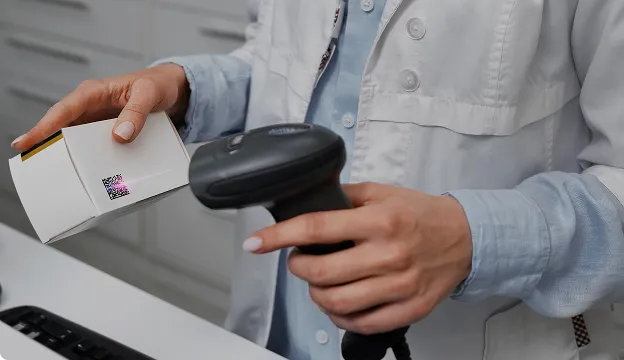

Chaque mouvement du produit dans la chaîne logistique est transmis au système de marquage3. DISTRIBUTION

Le distributeur reçoit et scanne le lot de produits, puis l'envoie aux magasins et supermarchés4. DÉTAIL

Lorsque le magasin reçoit un nouveau lot de produits, les employés scannent les codes sur l'emballage et vendent les produits légaux via la caisse enregistreuse5. CONSOMMATEURS

Au moment de la vente à la caisse, un scanner 2D lit le marquage, et le code DataMatrix est retiré du commerce du produitAvantages pour les parties prenantes

Pour les gouvernements

- Augmentation des recettes publiques grâce au contrôle total de la collecte des taxes

- Lutte contre les flux financiers illicites en identifiant les produits de contrebande, contrefaits et les contrevenants

- Protection de la santé et de la sécurité des citoyens en détectant et en rappelant les produits contrefaits

- Simplification de la bureaucratie et réduction des coûts opérationnels grâce à l'automatisation de l'administration des taxes d'accise

- Réponse rapide aux fluctuations et tendances du marché avec un accès en temps réel aux données du marché

Pour les entreprises

- Sécurisation de la réputation de la marque en éliminant les produits contrefaits

- Protection des consommateurs et de la réputation de l'entreprise grâce à des rappels de produits efficaces

- Amélioration de la gestion des stocks avec le suivi en temps réel du mouvement des marchandises

- Rationalisation de l'importation et de l'exportation de produits grâce à l'interopérabilité du système numérique de traçabilité

- Promotion d'une concurrence loyale via un mécanisme efficace de conformité fiscale

- Interaction directe avec les consommateurs à l'aide d'outils de communication B2C intégrés

Pour les consommateurs

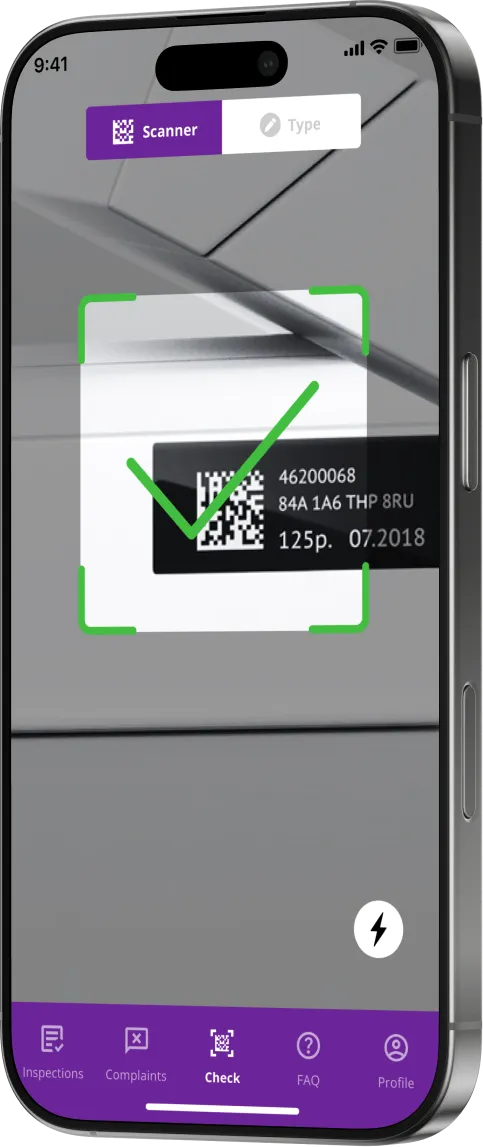

- Protection des droits, de la santé et de la sécurité des consommateurs grâce à des vérifications d'authenticité des produits par mobile

- Garantie de l'authenticité des produits avec des codes de marquage uniques et sécurisés

- Facilitation des retours et des réclamations de garantie avec accès aux données d'achat vérifiées

- Participation aux campagnes marketing via des outils B2C intégrés

Installez l'Application Mobile d'Authentification des Produits

Dans l'application, vous pouvez vérifier les informations du produit, y compris son origine et son fabricant, et déposer une plainte en cas d'article contrefait.Télécharger